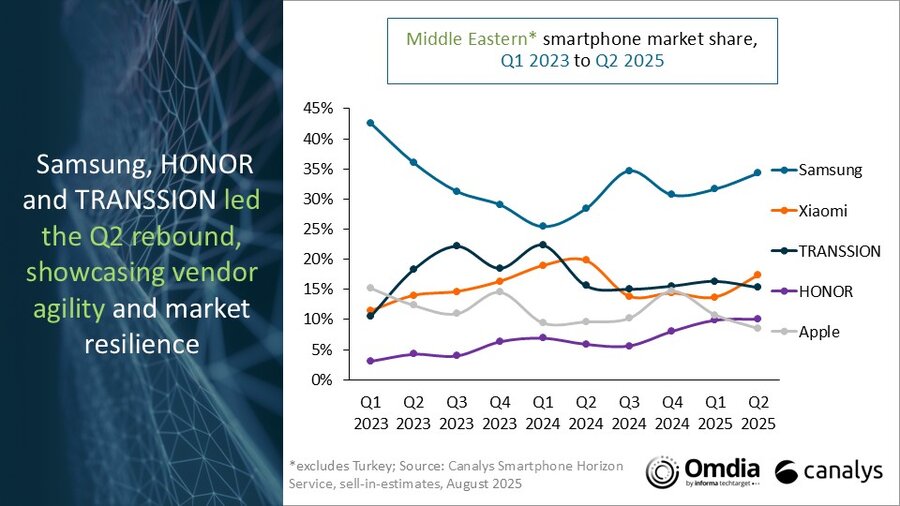

Middle East Smartphone Shipments Surge in Q2 2025, Rebounding from Early-Year Slump

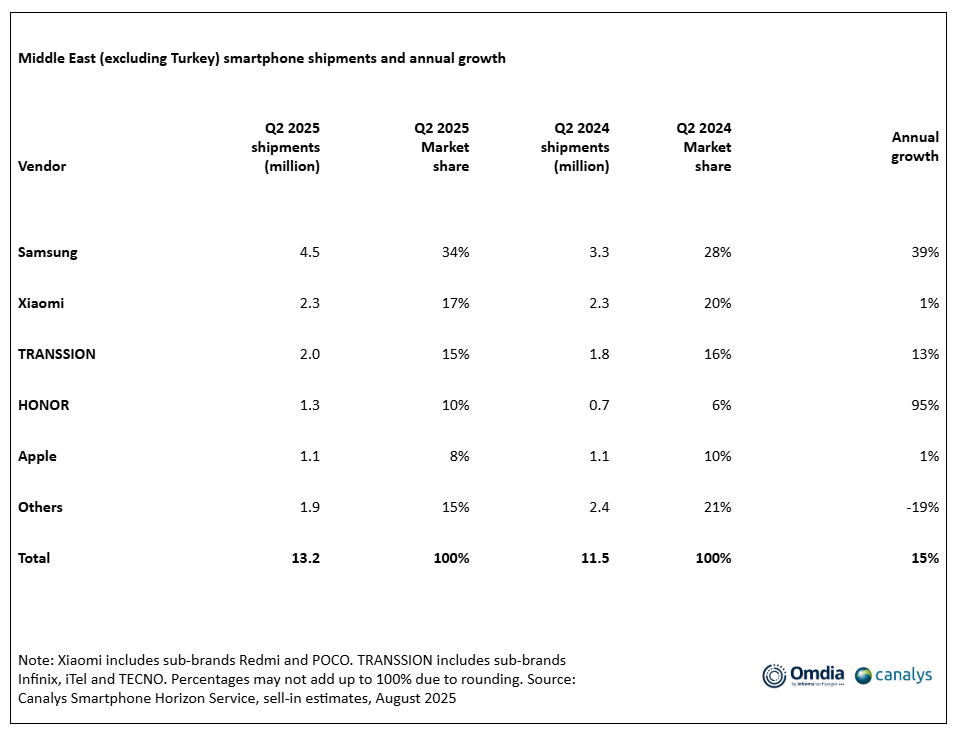

The latest research from Canalys (now part of Omdia) reveals that the Middle East’s (excluding Turkey) smartphone market grew 15% to 13.2 million units in Q2 2025, making it the strongest-growing region worldwide. The rebound was powered by value-conscious buyers, festive season spending and strong economic momentum, positioning the region for continued expansion in smartphone shipments despite geopolitical headwinds.

“The Middle East’s smartphone market delivered its highest quarterly volume since Q2 2019, reflecting strong and consistent demand across the region,” said Manish Pravinkumar, Principal Analyst at Canalys (now part of Omdia). “Following a muted start to the year in Q1, the region rebounded strongly in Q2 2025, fueled by channel replenishment and vendors refreshing their mid-tier portfolios. For many vendors, the Middle East has become a core investment target for growing their businesses, aligning with regional governments’ bold visions and infrastructure projects, rising disposable incomes, expanding addressable markets and a diversifying economy. With improving political stability, a steady influx of travelers and its role as a global commercial crossroads, the region is cementing its status as a launchpad for success both locally and internationally.”

“Samsung and HONOR both had exceptionally strong performances in Q2, reaching high double-digit growth rates in Q2,” said Pravinkumar. “Samsung benefits across the region, particularly from more targeted use of its entry-level Galaxy A series 4G models. Additionally, the enduring demand for the Galaxy S25 series and S24 FE is being fueled by buy-now-pay-later options and faster refresh cycles driven by an increased desire for consumers to update. HONOR nearly doubled its shipments compared with Q2 2024, with the GCC emerging as a core growth market. Its rapid rise is underpinned by aggressive retail expansion, a strong AI-driven product proposition that resonates with local consumers and compelling channel incentive programs. Combined with bold promotions and an expanding network of Experience Stores, these factors have been pivotal to HONOR’s success.”

“AI needs to be the backbone in all vendors’ strategies in the Middle East, both to capture consumers’ interest, channel traction and business opportunities,” added Pravinkumar. “The region is quickly becoming a global AI hub, led by the UAE, Saudi Arabia and Qatar, which are deeply integrating AI into their national strategies. This is resulting in growing consumer interest, making it a vital component to capture users through eye-catching features and targeted influencer campaigns, and to match technological infrastructure investments that are being built and expanded. To win, vendors must combine advanced AI features, such as real-time translation, hyper-personalized recommendations and instant content creation, with strong creator partnerships to drive engagement, shape consumer preferences and convert influence into loyalty in an increasingly competitive market.”