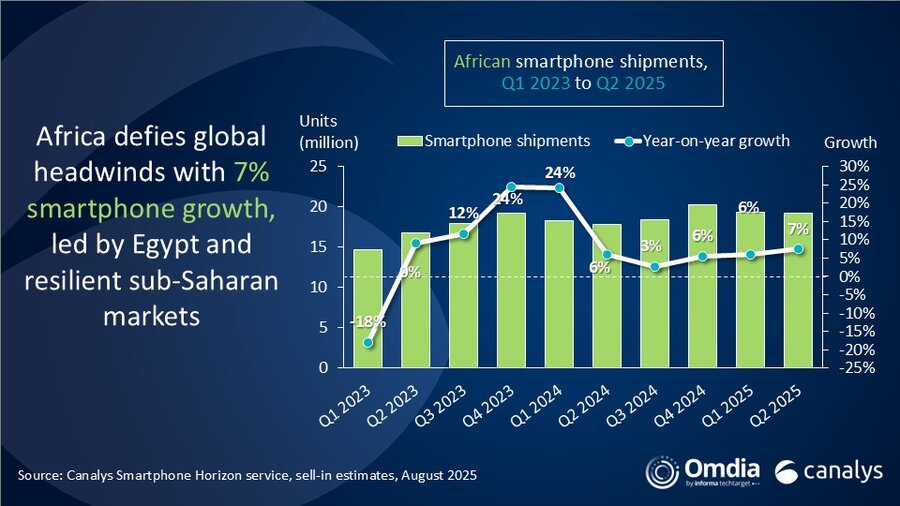

Africa’s Smartphone Market Grows 7% in Q2 2025

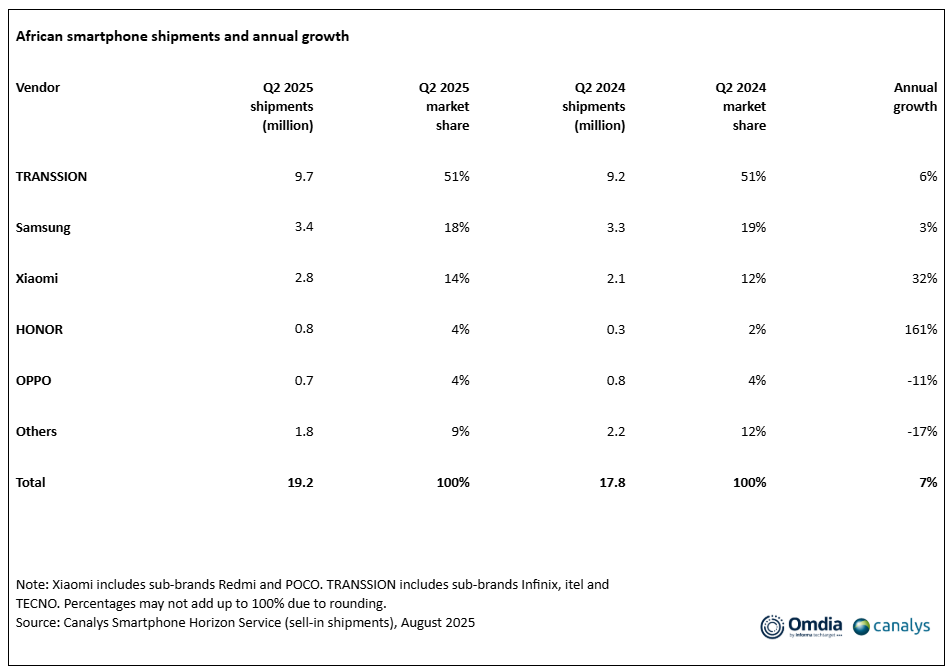

According to the latest research from Canalys (now part of Omdia), Africa posted solid 7% year-on-year smartphone shipment growth, reaching 19.2 million units in Q2 2025 – making it one of the best-performing regions worldwide. This growth was powered by easing inflation in key markets, such as Egypt, Nigeria and South Africa, and currency stability strengthening consumer buying power. With Africa forecast to sustain a compound annual growth rate of 2.1% from 2025 to 2029, it is set to outpace the subdued global smartphone market.

Egypt led the North African market with 21% growth, as vendors leveraged the accelerated local manufacturing capacity established this year to meet the strong demand during the Eid promotion season, while Sub-Saharan Nigeria rebounded by 10% on easing inflation and a more stable naira. South Africa grew 2% year on year, with 5G smartphone shipments surging 63%.

The expansion was driven by the broader adoption of financing options, increasing 5G penetration and strategic partnerships with operators, which have become critical for vendors seeking growth. Kenya declined just 2%, showing relative resilience. By contrast, Algeria plunged 27% and Morocco fell 7% amid weak demand and tighter import restrictions, while Senegal posted a modest 3% rise. Overall, Africa’s growth remains anchored by its largest economies, even as smaller markets face structural pressures.

“Demand for ultra-low-cost smartphones is reshaping Africa’s market, with sub-US$100 models soaring 38% in Q2 and keeping average selling prices on a downward trend since 2023,” said Manish Pravinkumar, Principal Analyst at Canalys (now part of Omdia). TRANSSION held onto the top spot with 6% growth but faces the challenge of climbing the value chain, despite TECNO’s mid-range push.”

Pravinkumar further explained, “Samsung grew 3%, extending its reach beyond South Africa into Egypt and Nigeria through localized distribution, retail expansion and affordable launches, such as the A06. Xiaomi leapt 32% to secure third place with a 14% share, powered by strong gains in Nigeria and Egypt, aggressive channel expansion and deeper local investment. HONOR strengthened its momentum with budget and mid-range bestsellers, such as the X7c and 400 Lite, supported by operator tie-ups, with South Africa now contributing 64% of its regional business. Meanwhile, OPPO, despite an 11% dip, is restructuring and doubling down on Egypt and beyond, opening its first combined Experience and Service Store at Cairo’s Citystars Mall. This marks the start of a wider retail expansion strategy, adding to its 14 existing outlets and reinforcing its long-term commitment to deeper customer engagement and accessibility in the region.”

According to the latest forecast from Canalys, Africa’s smartphone shipments are set to grow 3% in 2025, outpacing a subdued global market despite rising component costs in the second half. “Africa’s rural markets are emerging as the next major battleground, where limited access to traditional banking is driving demand for mobile money, fintech and digital services,” said Pravinkumar.

He added, “Yet, smartphones have only just surpassed half of total connections, with feature phones deeply entrenched in low-income communities. Affordability remains the greatest barrier, forcing vendors to double down on ultra-low-cost models, device financing schemes and localized strategies. At the same time, Africa is shifting from being just a consumption hub to becoming an assembly base, with Egypt and Ethiopia leading, while Uganda and Algeria build smaller ecosystems. ‘Made in Africa’ is fast becoming a necessity – unlocking cost advantages and leveraging regional trade agreements that cut tariffs and spur local manufacturing. The outlook is clear: the convergence of local production and digital finance adoption will shape the next wave of sustainable growth, cementing Africa as a proving ground for global brands.”